31+ Va loan closing cost calculator

On average the closing cost for a conventional loan falls between 3 percent to 6 percent of the homes value. With a true VA construction loan.

How To Effectively Avoid These 5 Home Buying Mistakes Middleburg Real Estate Atoka Properties Buying First Home Home Buying First Time Home Buyers

The average 30-year VA mortgage APR is 5270 according to Bankrates latest.

. Estimated monthly payments shown include principal interest and if applicable any required mortgage insurance. Discover the benefits of a VA loan and VA mortgage rate information from USAA. Your legal liability for the debt doesnt automatically disappear upon completing an assumption.

2 to 5 percent of the mortgage amount which would equal 3000 to 7500 on a 150000 loan. You can change loan details in the calculator to run scenarios. FHA Streamline closing costs are typically the same as other mortgages.

She has helped Veterans in almost every possible circumstance including active duty personnel deployed overseas returning home with PCS orders as well as separated and retiring VeteransRead More. August 31 2022 504-367-2333. ARM interest rates and payments are subject to increase after the initial fixed-rate period 5 years for.

Mortgage rates valid as of 31 Aug 2022 0919 am. Texas Vet VA Loan Specialist Shirley Mueller. We have built a real estate closing cost calculator to help you to understand approximately how much your property closing will cost you based on answers to a number of questions.

Todays national VA mortgage rate trends. The 52-week high rate for a VA fixed mortgage rate was 536. If you have a VA loan you may be required to pay a VA funding fee at closing.

This calculator allows you to select your loan type conventional FHA or VA or if you will pay cash for the property. 181 continuous days. The form puts the loans key characteristicssuch as interest rate.

This includes upfront costs such as underwriting fees broker fees and loan origination fees. Release of Liability on a VA Loan. A closing disclosure is a five-page form that federal law requires lenders to complete and give to borrowers before closing.

For today Wednesday August 31 2022 the national average 30-year VA mortgage APR is 5270 up compared to last weeks of 5100. Note 4 VA loans require a one-time fee called a VA funding fee which may be. Cost of living comparison calculator.

Central Daylight Time and assume borrower has excellent credit including a credit score of 740 or higher. This typically ranged between 2 5 of your loan amount. Lenders will lend the lesser of the homes acquisition costs and its fair market value.

Since 2003 Shirley has originated well over 2000 Texas Veteran and VA Loans. For example if your loan is worth 320000 your closing costs can be anywhere between 6400 to 16000. Todays rate on a 30-year fixed VA loan is 516 compared to the rate a week before of 499.

Government-backed VA loans require no down payment or PMI insurance. Assumptions pose different challenges that affect your remaining entitlement and even your credit. Closing costs are fees charged by lenders to process your mortgage application.

Once this key step is complete and the proposed home meets VA guidelines your loan can move to closing. Use this calculator to quickly estimate the closing costs on your FHA home loan. What Are Todays VA Mortgage Rates.

The seller can also look to restore their full VA loan entitlement once theyve repaid that original loan. August 31 2022 the national average 30-year VA refinance APR is 5340. Here is a more in-depth closing cost calculator which highlights individual fees you can expect to pay.

This is a large sum so be sure to include it in your budget. FHA Closing Cost Calculator. For example if you buy a house worth 450000 the closing cost can be anywhere between 13500 to 27000.

The typical limits on front-end ratio back-end ratio are 3143 though people with compensating factors may be approved up to a back-end ratio as high as 57.

Tips For First Time Home Buyers Myhomeanswers

How Buy A House Without A Realtor Hauseit Realtors Buying A Condo Personal Financial Statement

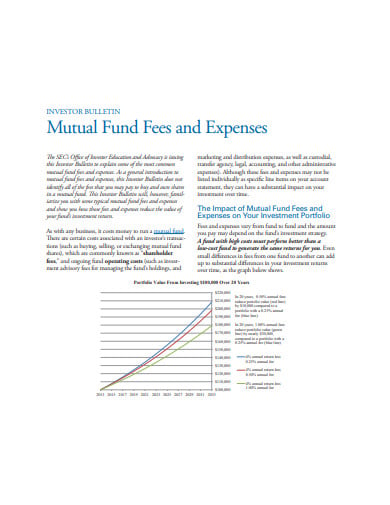

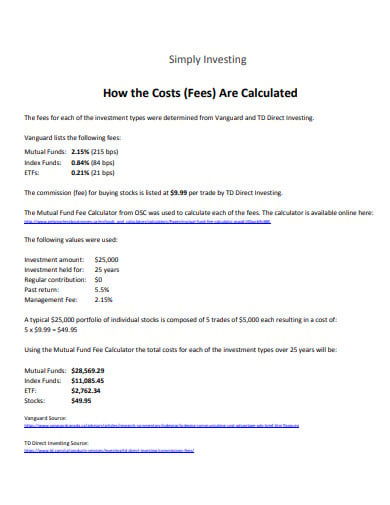

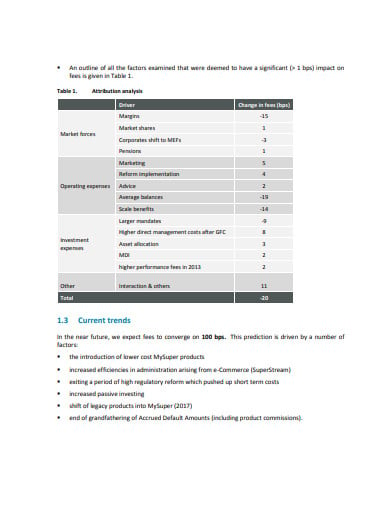

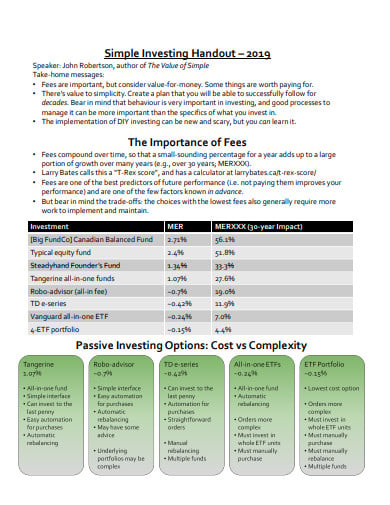

4 Investment Fees Calculator Templates In Pdf Free Premium Templates

Key Terms To Know In The Homebuying Process Infographic Home Buying Process Process Infographic Home Buying

A Complete Guide To Closing Costs In Kentucky Closing Costs Fha Loans How To Memorize Things

To Do List For First Time Buyers Home Buying Real Estate First Time Home Buyers

We Ve Dropped Our Minimum Fico Score To 620 For Kentucky Mortgage Loan Approvals Mortgage Loans Va Mortgage Loans Mortgage Lenders

4 Investment Fees Calculator Templates In Pdf Free Premium Templates

Renting Vs Owning A Home Real Estate Tips Buying First Home Home Buying Tips

Terms To Know Before You Start Your Home Search Real Estate Terms Home Buying Process Real Esate

Tips For First Time Home Buyers Myhomeanswers

Kentucky Mortgage Rates And Home Loan Options Mortgage Loans Home Loans Home Mortgage

Incredible 2 Months From 2nd Of December Conventional Loan Mortgage Loans Mortgage Refinance Calculator

4 Investment Fees Calculator Templates In Pdf Free Premium Templates

Pin By Kim Loeffler Mortgages Made On Mortgages Made Simple Mortgage Checklist Mortgage Mortgage Loan Officer

4 Investment Fees Calculator Templates In Pdf Free Premium Templates

4 Investment Fees Calculator Templates In Pdf Free Premium Templates