Drop retirement calculator

30 2022 is 298. A retirement planner and Social Security calculator are also provided.

Drop Vs Deferred Retirement Pensioncheck Online Fppa

However you can take.

. 515 254-9200 Toll-Free. With a minimum guaranteed rate that it cannot drop below. Since in-person seminars have been postponed for an uncertain time-frame we hope this presentation can provide members with basic information about the APRS benefit plan.

1114 Market Street Room 900. Begin with information about you including your annual salary the state you. 888 254-9200 Fax.

You can see the effect of three different rates of return on the size of. For backtesting Monte Carlo simulation tactical asset allocation and optimization and investment analysis. This retirement plan offers a pension after 20 years of service that equals 25 of your average basic pay for your three highest-paid years or 36 months for each year you serve.

Here we have provided TS Grewal Accountancy solutions for Class 12 in a simple and a step by step method which is beneficial for the students to score well in their upcoming board exams. The T-Bill face value can be added by either selecting a common value from a drop down list or you can manually enter the T-Bill face value in the the Other Value box if not in the list. You can change it using the drop-down the more you take the less time your money will last.

MFPRSI 7155 Lake Drive Suite 201 West Des Moines IA 50266 Phone. With tax benefits that are mainly available through an employer. The order of the screens top to bottom.

TS Grewal Solutions for Class 12 Accountancy Chapter 6 RetirementDeath of a Partner is a fundamental concept to be learned by the students. Bank of America stock is down 275 in 2022 compared to a loss of just under 19 by the SP 500 SPX 030 and a drop of 186 by the Financial Select SPDR ETF XLF 030 as of Fridays close. OPF uses a variable interest rate for DROP and re-employed retiree accounts The interest rate for the period of July 1 2022 through Sept.

Er the amount of your second stimulus check will drop if your AGI exceeds 150000. Deciding when to start your benefits can be a difficult decision. Please contact the System directly to have individual questions addressed.

Related Retirement Calculator Roth IRA Calculator Annuity Payout Calculator. If you withdraw money from your traditional IRA before age 59 12 theres a 10 early withdrawal penalty and that is in addition to the income tax due on each withdrawal. The results of this calculation will be shown on the screen with a detailed output of the inputs assumptions and Plan data that were used in the.

FRS Online Services benefit calculator service history etc Division of Retirement DOR Calculations. How to use the High-3 military retirement calculator. Deferred Retirement Option Plan DROP View Department Menu Contact Info.

Once you decide to cancel this the money will be rolled over back to you likely as a lump sum. Pension Calculator Contributions Eligibility Employers Highlights of the System. Employees in each Retirement System have somewhat different Contribution and Benefit amounts as well as different Eligibility requirements for retirement.

Try our equity calculator or call us on 1300 622 100. Its simple to use just add your age and the amount in your pension pot below. Vested Pension Plan members who reach their normal retirement date may participate in the DROP.

Free annuity calculator to forecast the growth of an annuity with optional annual or monthly additions using either annuity due or immediate annuity. Deferred Retirement Option Program DROP This program was created as a temporary alternative to the FRS Pension Plan. In contrast MYGAs pay a specific percentage yield for a certain amount of time.

Health Science Center Faculty are required to participate in the ORP. Welcome to the Austin Police Retirement System Retirement Education Seminar virtual edition. Fidelity has a comprehensive list of tools and calculators which cover investing and retirement.

Try our equity calculator or call us on 1300 622 100 to see how using your Household Capital could improve your retirement income so you can stay safe and Live Well At Home. Portfolio Visualizer by forum member pvguy. Add the the face value of the bond.

Second Stimulus Check Calculator. Once a participant clicks the Calculate button on this screen a calculation will run in the background. 2022 survey data from the global financial services company Charles Schwab says that inflation 45 monthly bills 35 stock market volatility 33 unexpected expenses 33 credit card debt 24 and education savings and costs for children 21 are preventing American workers from putting more money into retirement savings.

Specific information related to these provisions can be found by visiting the specific Retirement System links below. It is named after subsection 401k in the Internal Revenue Code which was made possible by the Revenue Act of 1978. The US T-Bill Calculator can be used to calculate the interest rate on your treasury bond using the following steps.

Feel free to drop as many Calculator Screen instances as you require into the white area below. Feel free to drop as many Calculator Screen instances as you require into the white area below. If you claim the head-of-household filing status on your tax return.

DROP was approved by the Board of Supervisors for retirement eligible members of the Police Officers and Uniformed Retirement Systems of Fairfax County October 1 2003. Treasury Note Business Day Series as published by the United States Federal Reserve with a cap of 50 percent. Dont include any final salary pensions or your state pension.

8 1980 and July 31 1986 you can use the High-3 Calculator to figure out your estimated base pay. As of April 2 2012 the rate will be equal to the 10-year US. In February 2012 the OPF Board of Trustees.

Annual Savings for Retirement are no longer needed. Fairfax County manages three Defined Benefit Retirement Systems. If you joined between Sept.

Employees Retirement System information concerning Contributions Eligibility Employers and Retirees. Click Print your results and select Save as pdf from the Destination drop down list Expand All. Depending on your savings rate and pay this could equate to 14 of annual pay.

A 401k is a form of retirement savings plan in the US. Tax efficiencies associated with drawing a lesser income overall 2 Living expenses and spending habits typically drop over the course of a 30 year retirement equating to a 5-15 reduction in annual spending. It enables participants to transfer their retirement assets to DROP so they can earn interest in the FRS Trust Fund.

Using our retirement calculator you can see the potential return on 401k contributions and how close you may be to your retirement goals. The order of the screens. The Canada Pension Plan is a significant source of retirement income.

See how using your Household Capital could improve. This Canada Pension Plan Calculator will quickly import your Statement of Contributions to provide you with how much income you can expect depending on which age you start your CPP benefits. This can be chosen by clicking on the drop down and choosing one of the four rates.

You should use our reverse mortgage calculator to see how using your home equity could transform your retirement. DROP was approved for members of the Employees Retirement System effective July 1 2005.

The Measure Of A Plan

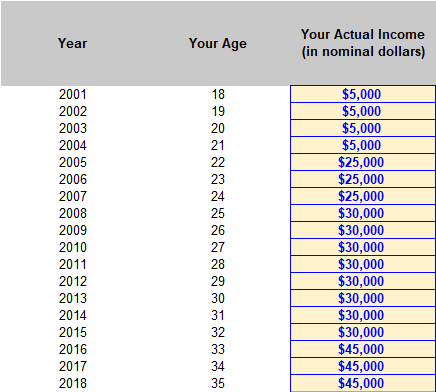

How To Calculate Retirement Date From Date Of Birth In Excel

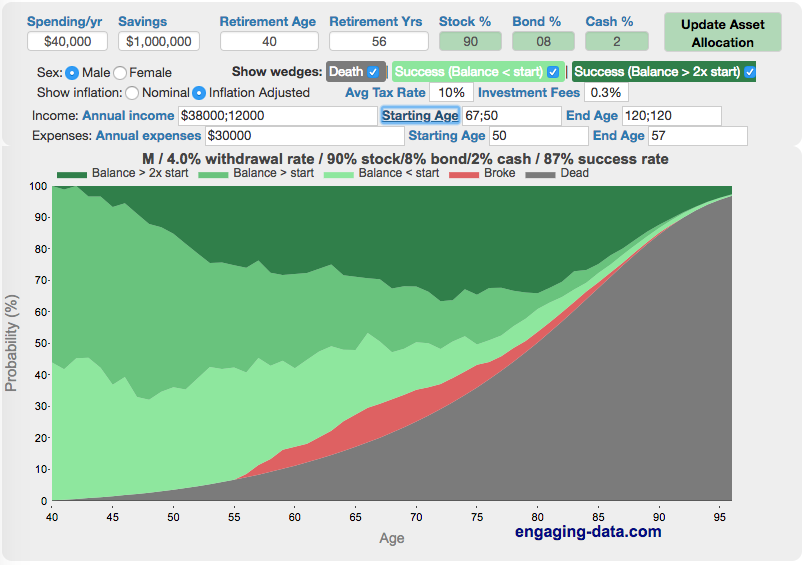

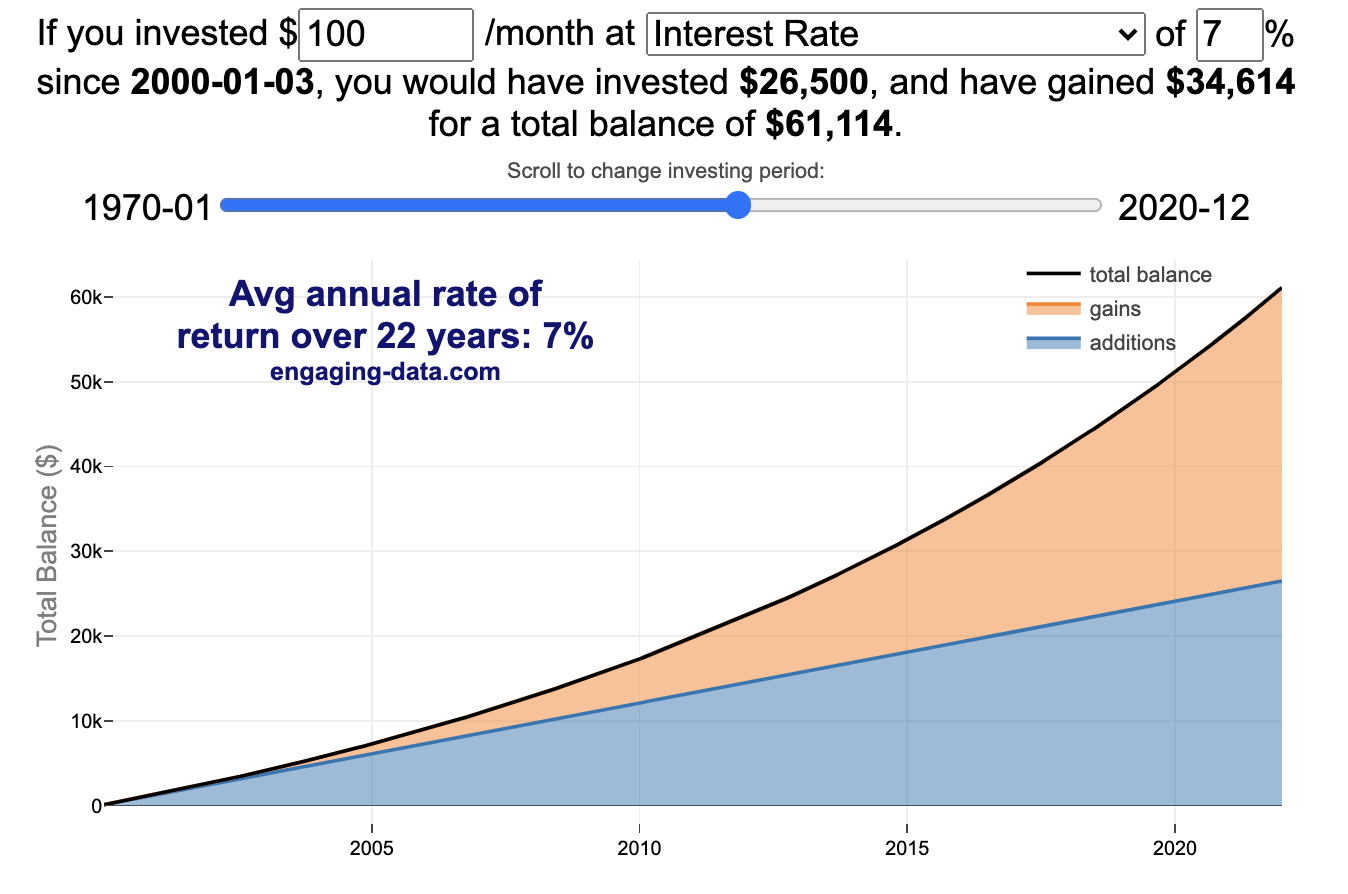

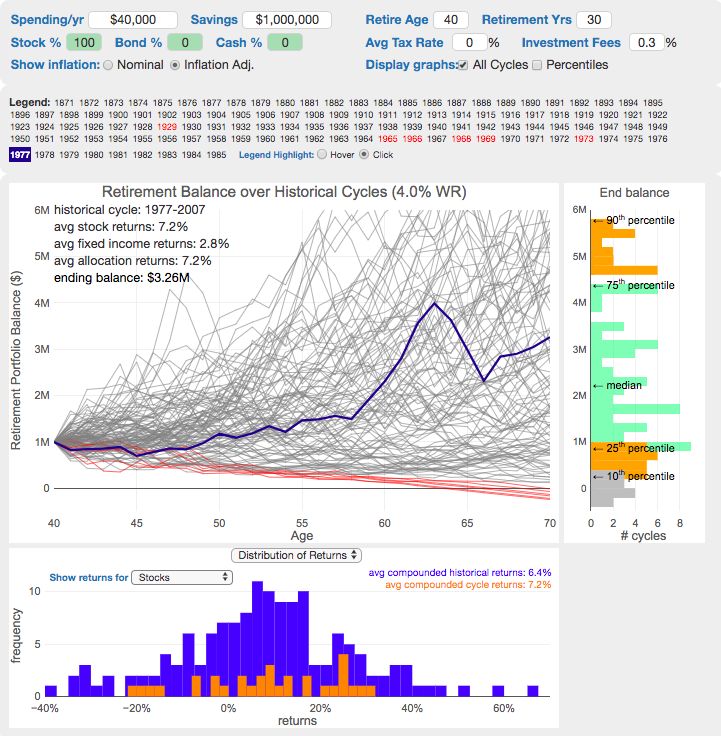

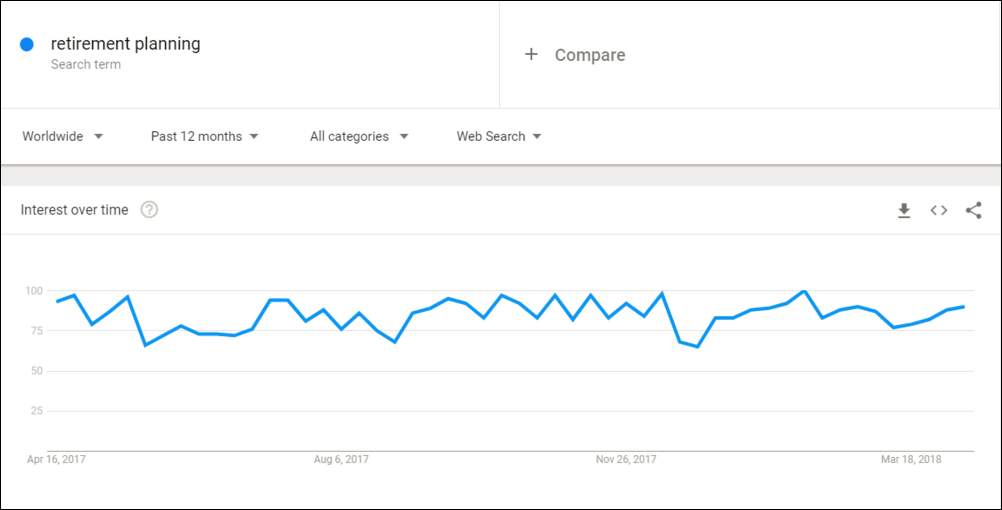

Early Retirement Calculators And Tools Engaging Data

Best Excel Tutorial How To Build A Retirement Calculator In Excel

How To Calculate Retirement Date From Date Of Birth In Excel

Sdcers 2021 Deferred Retirement Option Plan Drop Interest Rates

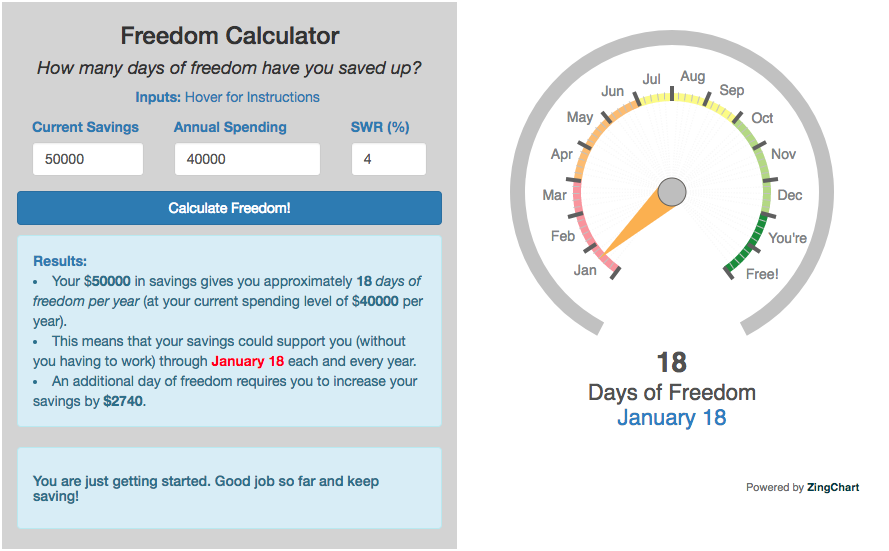

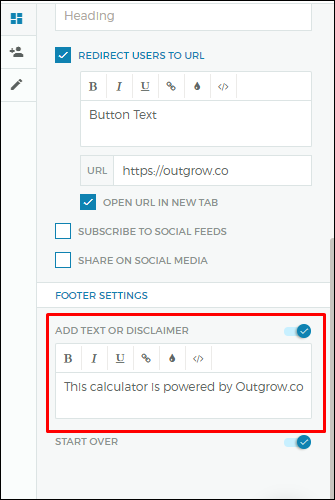

How To Build A Retirement Calculator Interactive Calculator Outgrow

Early Retirement Calculators And Tools Engaging Data

Early Retirement Calculators And Tools Engaging Data

Early Retirement Calculators And Tools Engaging Data

Drop Vs Deferred Retirement Pensioncheck Online Fppa

Early Retirement Calculators And Tools Engaging Data

Calculators City Of Fresno Employee Retirement System

Calculators City Of Fresno Employee Retirement System

Best Excel Tutorial How To Build A Retirement Calculator In Excel

How To Build A Retirement Calculator Interactive Calculator Outgrow

Drop Vs Deferred Retirement Pensioncheck Online Fppa