42+ tax implications of co signing a mortgage

That could increase your debt-to-income ratio making it harder for. Any late payment foreclosure or other action by the lender after missed payments will affect your own credit report and.

Icpna Focus On Grammar 5b Pdf

View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage.

. Even the best-laid plans can go wrong and. Youll need a cosigner with a score of at least. Apply Now To Enjoy Great Service.

Web A co-signer is typically required if the person applying doesnt have sufficient credit history their income is too low or they are not seen as a reliable borrower in the. Ad Compare More Than Just Rates. Ad Highest Satisfaction for Mortgage Origination.

Web Up to 25 cash back As a cosigner not only will your credit scores fall but youll also be liable for repayment of the debt including late fees and collection costs. Low Interest Online Lenders Comparison Reviews Top Brands Free Online Offers. You may accumulate an obligation to pay capital gains taxes down the road.

Web If youre cosigning for a purchase get copies of all important papers. Web There can be implications with respect to your personal income taxes. Web When you co-sign on a home mortgage you are essentially applying for a home loan with the person who is purchasing the home.

Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web Understanding the tax implications of co-signing a childs mortgage The Canada Revenue Agency recently responded to a taxpayer inquiry involving parents. Web Cons of cosigning a mortgage Your credit could decline.

This includes documents like the loan contract the Truth-in-Lending Act disclosure statement. Web However there are reasons to be cautious about co-signing a mortgage even if youre trying to lend a hand to a sibling or a pal. Web If you want to apply for your own loan at anytime this cosigned mortgage could count as debt.

Web A mortgage co-signers income is used to help a borrower qualify for a mortgage loan. Web When parents assist their kids by cosigning loans the parents may think of themselves as guarantors but if the lender requires the parents to be co-owners and co. Ad How Much Interest Can You Save by Increasing Your Mortgage Payment.

Find A Lender That Offers Great Service. Web Your potential cosigner should have a good credit score of 620 or higher if youre applying for a conventional loan. As a result your credit score will.

Co-signing a mortgage is a major obligation as youre promising to.

42heilbronn Coding School

42 Sample Offer Letter Templates

42 Agreement Templates Word Pdf Apple Pages

Report January June 2019 By Nabu Issuu

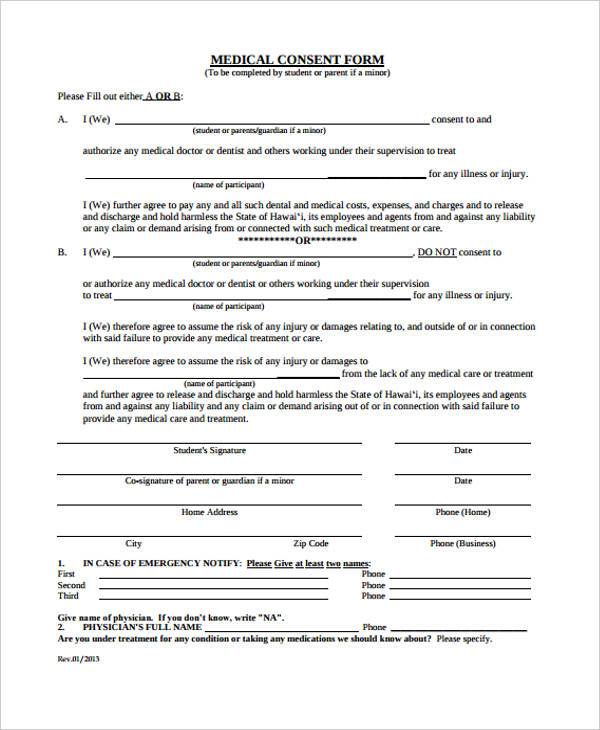

Free 42 Consent Forms In Pdf Ms Word Excel

Financial And Tax Implications Of Co Signing A Mortgage In Canada Canadian Real Estate Wealth

Business Succession Planning And Exit Strategies For The Closely Held

Free 42 Certificate Forms In Pdf Ms Word Excel

42heilbronn Coding School

Metropol 17 February 2022 By Metropol Issuu

Banking Notes With Digests From Kriz P Cha Mendoza Pdf Foreclosure Loans

Co Signer Tax Deductions Pocketsense

Very Often The Tatiana Mikhailova Mortgage Broker Facebook

7 New Glass Review Pdf Pdf

Financial And Tax Implications Of Co Signing A Mortgage In Canada

Vocabular French Pdf Idiom Adjective

The Benefits And Risks Of Co Signing For A Mortgage